Even the best planned trips can have the unexpected. Travel Insurance can help you along the way if the unforeseen happens, here are a few reason you should consider travel insurance on the more pricey trips.

1. What if you need to cancel your trip?

One of the most common reasons people consider travel insurance is the worry that they may have to cancel their trip and lose money you have already paid for. Life is unpredictable and it’s impossible to know what might happen between planning a trip and leaving. If you think you’re spending more on your vacation than you can afford to lose, you may want to consider buying travel insurance

2. Sickness or injury before or during a trip

What if you or a traveling companion becomes sick and can’t travel ? Or for health reasons you are unable to make the trip? In those situations, travel insurance could help you out.

- If you need to cancel your trip because your child is sick and can’t travel, you could be reimbursed for your prepaid, nonrefundable trip costs.

- If you are injured during the trip, travel insurance may cover your medical expenses, including an ambulance ride. Many health insurance plans do not cover international travel.

- If you can’t continue your trip as a result of the injury, Trip Interruption Coverage could reimburse you for the portion of the trip that you missed and even help you return home.

3. Adverse weather and natural disasters

The weather is something you really have no control over that could lead to delays or cause you to cancel your trip altogether. From snowstorms to hurricanes, travel insurance can cover you if bad weather or a natural disaster causes a covered event, like flight cancellations.

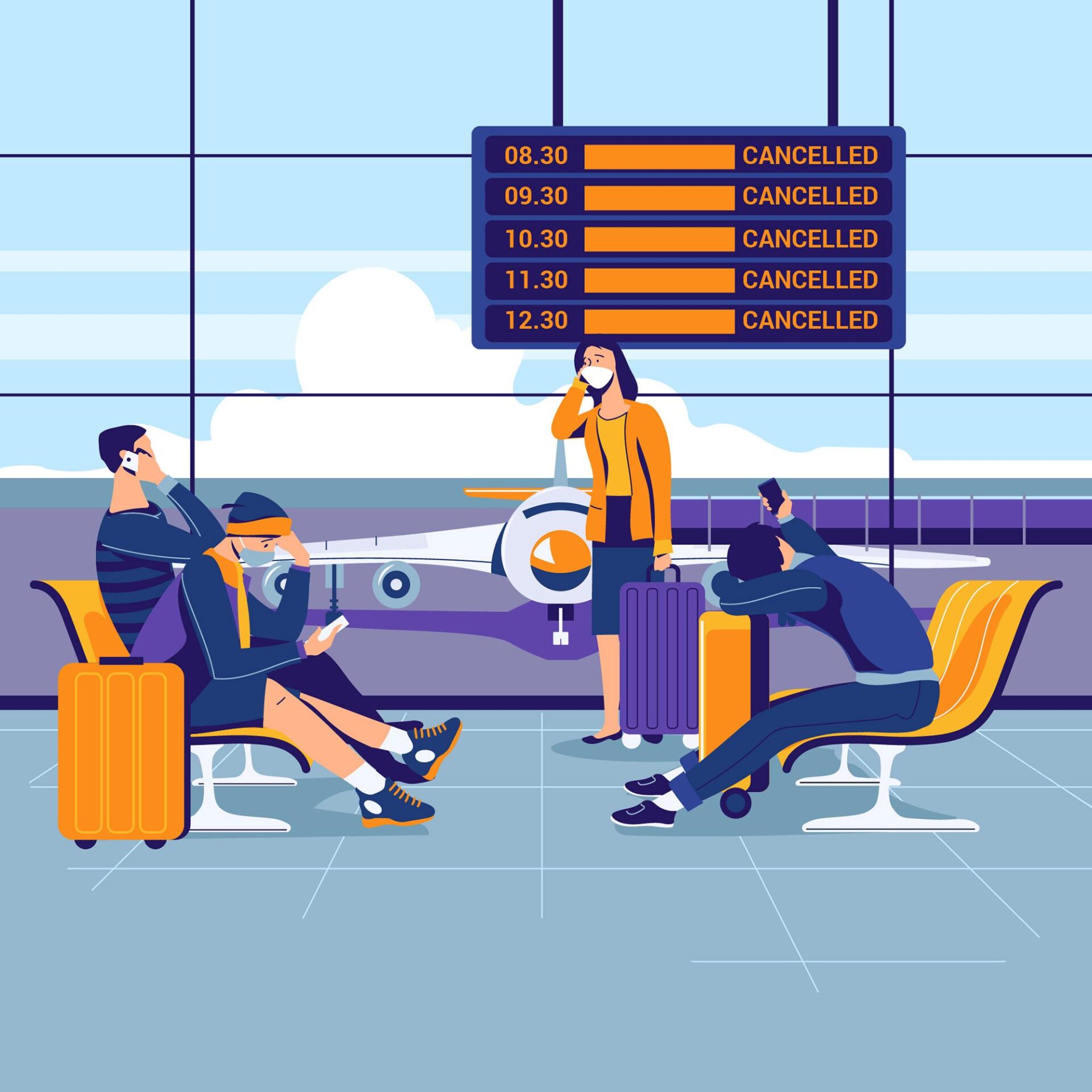

4. Travel delays or interruptions

Nearly 20% of flights were delayed in 2018 and there were more than 53,000 flight cancelations. Flight delays, flight cancellations, a stolen passport, traffic accident, natural disaster, and many other unexpected events could delay or completely interrupt your trip. A travel insurance plan can cover you in many of those situations, so you can focus on taking care of your needs during an inconvenience like that.

5. Lost, stolen or delayed baggage

In 2015, 23.1 million bags were lost, delayed or damaged by airlines and lost baggage took an average of 1.76 days to be returned to their owners. With the right travel insurance you can be reimbursed for lost, stolen or damaged baggage or personal items and a plan with Baggage Delay coverage can pay you back for the purchase of necessary items while your bags were delayed or lost.